Transform Debt Collection with AI-Powered Communication

Are you struggling to maintain consistent collection rates while staying compliant with ever-changing regulations? MissNoCalls’ Collection Agency AI Bot revolutionizes debt collection through intelligent automation, ensuring you recover more while maintaining perfect compliance.

😫 The Growing Challenges of Modern Debt Collection

In today’s fast-paced financial landscape, traditional debt collection methods are falling short. Collection agencies face mounting pressure from all sides:

- Overwhelming Call Volumes: Your agents can only handle so many calls per day, leaving valuable opportunities untouched

- Strict Regulatory Requirements: Keeping up with FDCPA, TCPA, and Reg F compliance demands constant vigilance

- Rising Operational Costs: Traditional staffing models are becoming unsustainably expensive

- Inconsistent Recovery Rates: Manual processes lead to varying results and missed opportunities

- Limited Availability: Operating only during business hours means missing crucial contact windows

The cost of these challenges? Industry data shows collection agencies lose up to 40% of potential recoveries due to timing, staffing, and compliance limitations.

“The traditional approach to debt collection isn’t just inefficient – it’s becoming impossible to sustain.”

❌ Collection Methods: Then vs Now ✅

🎯 Introducing MissNoCalls Collection Agency AI Bot

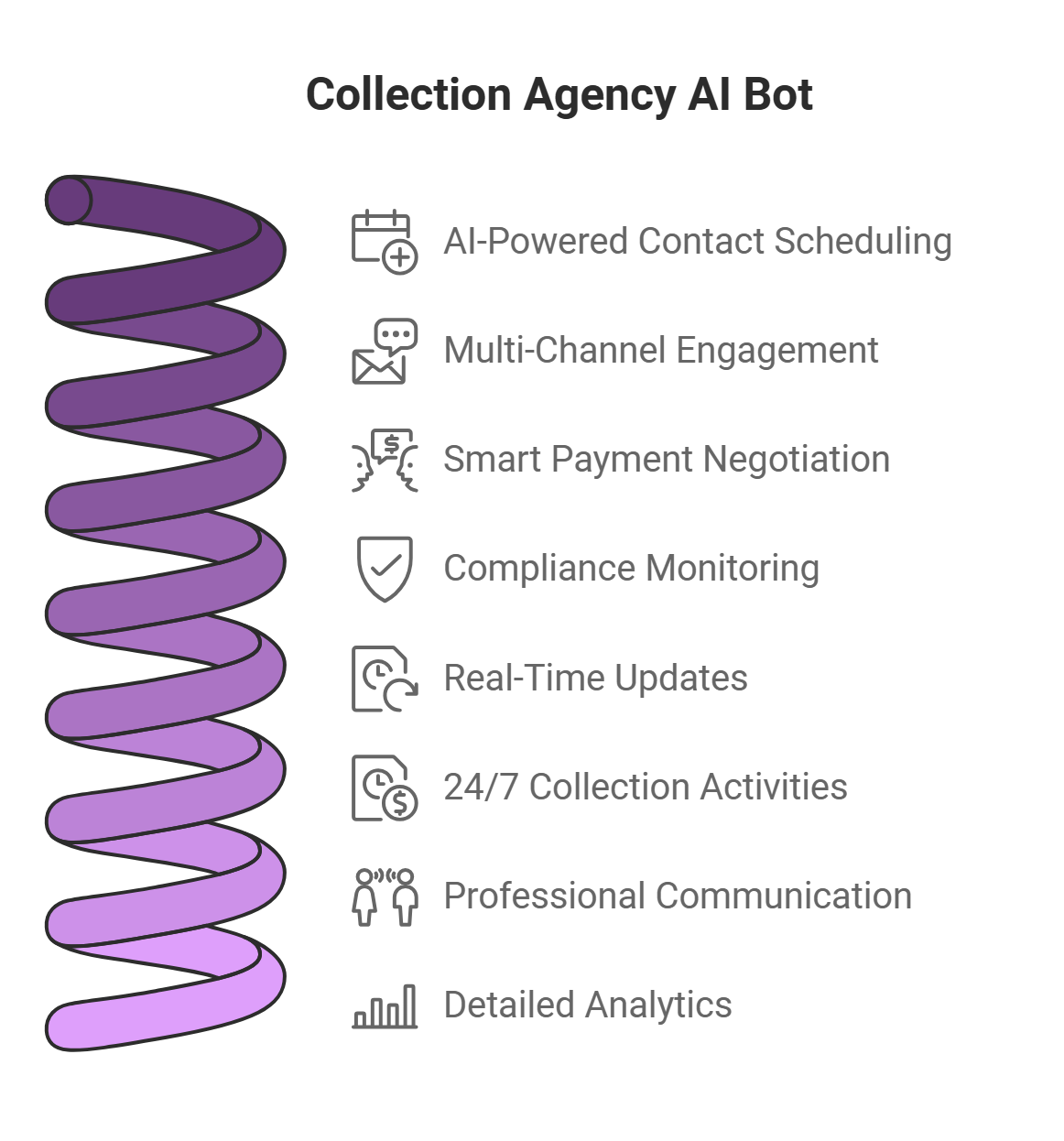

Our Collection Agency AI Bot transforms your collection operations with intelligent automation that works around the clock. Through our advanced AI Call Management Suite, we deliver:

Intelligent Recovery Optimization

- AI-powered contact scheduling based on propensity to pay

- Multi-channel engagement across voice, SMS, and email

- Smart payment negotiation and arrangement capabilities

Bulletproof Compliance

- 100% adherence to FDCPA, TCPA, and Reg F regulations

- Automated compliance monitoring and documentation

- Real-time updates to maintain regulatory alignment

Operational Excellence

- 24/7 collection activities without staffing overhead

- Consistent, professional communication at scale

- Detailed analytics and performance tracking

By leveraging our EngageSync technology, collection agencies using MissNoCalls have seen:

📈 35% increase in recovery rates

⚖️ 100% compliance maintenance

💰 60% reduction in operational costs

⚡ 3x faster contact-to-resolution time

“Our AI-powered solution doesn’t just automate collections – it transforms them, ensuring better results while maintaining perfect compliance.”

Learn more about how we’re revolutionizing debt collection through our AI in Customer Service solutions and discover why leading agencies are switching to MissNoCalls for their collection needs.

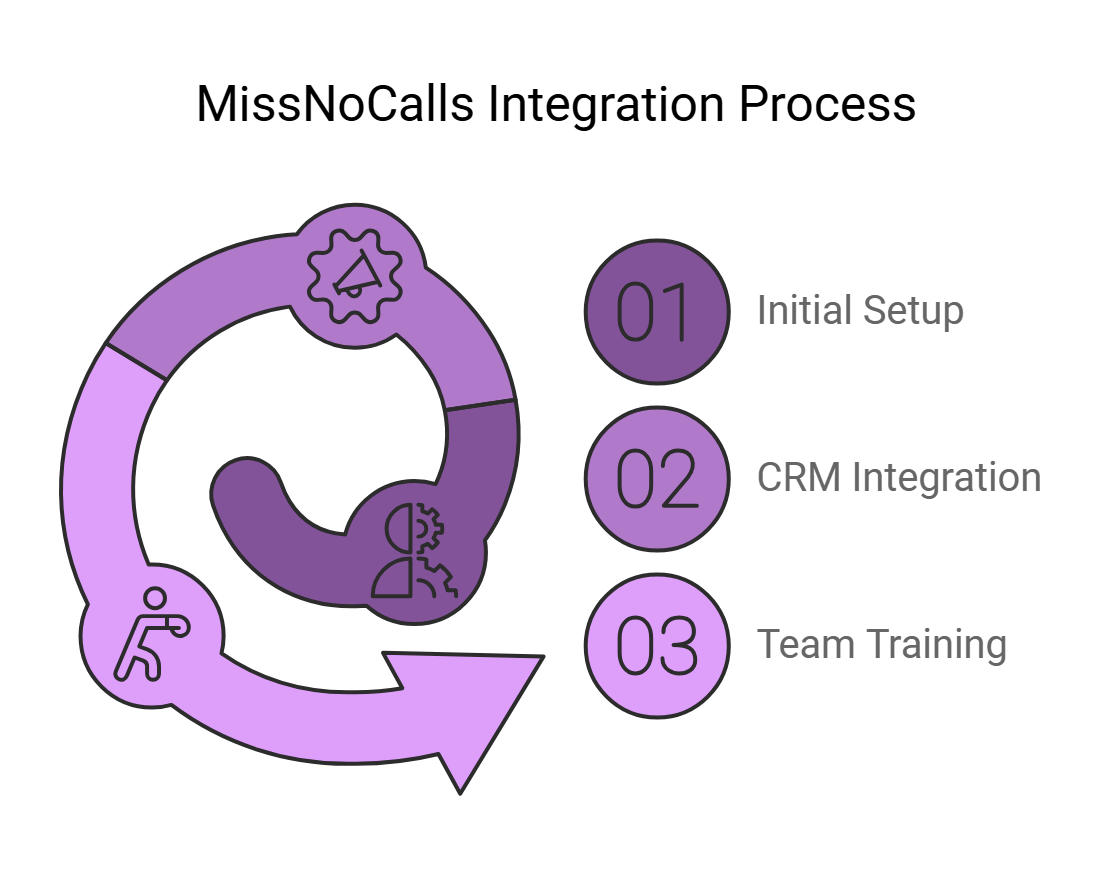

🔄 Simple Integration, Powerful Results

Getting started with MissNoCalls is straightforward:

- Initial Setup (24-48 hours)

- System configuration

- Voice AI training

- Compliance parameter setting

- CRM Integration

- Seamless connection with your existing systems

- Data synchronization

- Automated workflow setup

- Team Training

- Comprehensive onboarding

- Ongoing support

- Regular optimization sessions

Start building your custom solution with MissNoCalls AI Call Management Suite: Learn How.

💡 ROI Analysis: Collection Performance Metrics

Tired of industry averages holding you back? With MissNoCalls AI, you can achieve game-changing improvements in every aspect of your debt collection strategy. From skyrocketing contact rates to slashing costs, these metrics highlight the unmatched efficiency and success brought by AI-powered tools. Let’s compare the numbers and see how MissNoCalls transforms performance benchmarks.

| Metric | 📊 Industry Average | 🚀 With MissNoCalls AI | 📈 Improvement |

|---|---|---|---|

| 🎯 Right Party Contact Rate | 25% | 45% | +80% |

| 💬 Promise to Pay Rate | 15% | 35% | +133% |

| ✅ Payment Arrangement Completion | 45% | 75% | +67% |

| 💰 Cost per Contact | $4.50 | $1.80 | -60% |

| ⏱️ Average Resolution Time | 45 days | 27 days | -40% |

⚡ Features That Transform Debt Collection

🔄 24/7 Intelligent Collection

Never Miss a Connection with AI-Powered Engagement

With MissNoCalls’ 24/7 AI-Powered Engagement, you’ll ensure every debtor interaction is meaningful and efficient.

- Multi-Channel Communication: Engage across platforms, including voice, email, SMS, and WhatsApp.

- Smart Follow-Up System: Automate reminders and follow-ups to increase repayment rates.

Learn how EngageSync can streamline your communication: Discover EngageSync.

🛡️ Automated Compliance

Ensure Peace of Mind with Built-In Compliance Features

MissNoCalls simplifies regulatory adherence, ensuring your processes align with FDCPA, TCPA, and Reg F.

- Regulatory Adherence: Stay up-to-date with the latest legal standards.

- Documentation and Record-Keeping: Maintain accurate logs for audits and reviews.

- Risk Mitigation Features: Proactively avoid fines and legal complications.

Let SupportSync AI help you achieve effortless compliance: Explore SupportSync AI.

📊 Smart Recovery Optimization

Boost Your Collection Strategy with Data-Driven Insights

Our AI goes beyond automation—it optimizes every aspect of debt recovery.

- Predictive Analytics Integration: Forecast debtor behavior for tailored strategies.

- Behavioral Analysis: Understand repayment patterns to refine outreach.

- Personalized Collection Strategies: Increase success with debtor-specific engagement plans.

Enhance recovery with VoicePulse Outbound: Learn More.

📈 Performance Analytics

Real-Time Insights to Maximize Efficiency

Track your performance with comprehensive analytics tools built into our platform.

- Real-Time Reporting: Get instant visibility into key metrics.

- Recovery Rate Tracking: Monitor success and adjust strategies as needed.

- Compliance Monitoring: Stay ahead of legal requirements with detailed oversight.

See how our AI Call Management Suite keeps your operations running smoothly: Explore More.

🌟 Industry-Leading AI Communication Solutions

🏥 Healthcare AI Solutions

Transform patient scheduling and support with intelligent automation designed specifically for healthcare providers. Our HIPAA-compliant AI system ensures seamless patient communication while reducing administrative burden.

Explore Healthcare Solutions🏢 Real Estate Communication Hub

Revolutionize property management and client interactions with AI-powered response systems that never miss a lead. Handle property inquiries, schedule viewings, and manage tenant communications 24/7.

Discover Real Estate AI⚡ CallFlow AI Integration

Power your business with our flagship AI communication system that adapts to your specific industry needs. Experience seamless integration with your existing workflows and CRM systems.

See CallFlow in Action🔄 EngageSync Technology

Synchronize your customer interactions across all channels with our advanced AI engagement platform. Ensure consistent communication whether through calls, emails, or messages.

Explore EngageSync📊 AI Call Management Suite

Take control of your communication with our comprehensive call management solution. Monitor, analyze, and optimize every interaction for maximum efficiency.

Discover the Suite🚀 Ready to Transform Your Collection Results?

Don’t let another day of missed opportunities pass. Join the leading collection agencies who have already transformed their operations with MissNoCalls AI.

Schedule Your Free Demo Now

❓ Frequently Asked Questions

MissNoCalls AI system supports over 20 languages and multiple regional accents through advanced natural language processing technology. The system uses voice pattern recognition and dialect-specific training to ensure accurate communication across diverse debtor populations, with real-time language switching capabilities based on detected preference.

Yes, MissNoCalls’ Advanced AI Voicemail integrates seamlessly with popular CRM platforms to ensure smooth data synchronization. This integration allows for automatic updates to debtor records, ensuring all communication is tracked and accessible in real-time.

The AI system uses dynamic negotiation algorithms that operate within pre-set parameters for payment plans while adhering to all regulatory requirements. The system analyzes debtor financial information and payment history to offer appropriate payment arrangements, automatically documenting all negotiations and agreements for compliance purposes.